Linkways Diversified Futures Index

Index Details

Linkways Diversified Futures Index aims to generate returns in the short-medium term through the use of systematic trend-following algorithms applied across all asset classes. The strategy has demonstrated the ability to perform whether markets are rising or falling and has historically shown low correlation to traditional investments.

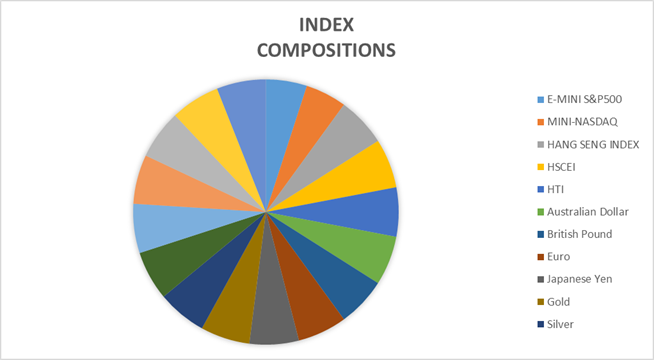

| Index Compositions | |||||

| Market | Name | Category | Exchange | Code | % |

| US | E-MINI S&P500 | Index | CME | ES | 5% |

| US | MINI-NASDAQ | Index | CME | NQ | 5% |

| HK | HANG SENG INDEX | Index | HKEX | HSI | 6% |

| HK | HSCEI | Index | HKEX | HHI | 6% |

| HK | HTI | Index | HKEX | HTI | 6% |

| US | Australian Dollar | Currency | CME | AD | 6% |

| US | British Pound | Currency | CME | GBP | 6% |

| US | Euro | Currency | CME | EUR | 6% |

| US | Japanese Yen | Currency | CME | JP | 6% |

| US | Gold | Metal | COMEX | GC | 6% |

| US | Silver | Metal | COMEX | SI | 6% |

| US | High Grade Copper | Metal | COMEX | HG | 6% |

| US | Platinum | Metal | NYMEX | PL | 6% |

| US | Crude Oil | Energy | NYMEX | CL | 6% |

| US | Heating Oil | Energy | NYMEX | HO | 6% |

| US | Natural Gas | Energy | NYMEX | NG | 6% |

| Cash | Cash | Cash | Cash | USD | 6% |

| 100% |

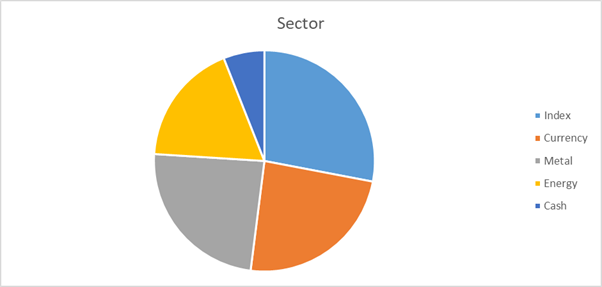

Category

| Index | 28% |

| Currency | 24% |

| Metal | 24% |

| Energy | 18% |

| Cash | 6% |

| 100% |

Exchange

| CME | 34% |

| HKEX | 18% |

| COMEX | 18% |

| NYMEX | 24% |

| Cash | 6% |

| 100% |

Rebalancing History

| Market | Name | Category | Exchange | Code | From Hold % | To Hold % | Rebalance Date |

| US | E-MINI S&P500 | Index | CME | ES | 0% | 1% | 2023/12/13 |

| US | MINI-NASDAQ | Index | CME | NQ | 1% | -1% | 2023/11/1 |

| HK | HANG SENG INDEX | Index | HKEX | HSI | 6% | 0% | 2023/8/9 |

| HK | HSCEI | Index | HKEX | HHI | 0% | -6% | 2022/5/5 |

| HK | HTI | Index | HKEX | HTI | -6% | 0% | 2022/3/1 |

| US | Australian Dollar | Currency | CME | AD | 0% | 1% | 2021/12/11 |

| US | British Pound | Currency | CME | GBP | 1% | -1% | 2021/9/8 |

| US | Euro | Currency | CME | EUR | 6% | 0% | 2021/9/8 |

| US | Japanese Yen | Currency | CME | JP | 0% | -6% | 2021/9/8 |

Simulation of Index NAV

Simulation of Index NAV (per $100 investment)

| 一月-18 | 100 |

| 二月-18 | 102 |

| 三月-18 | 103 |

| 四月-18 | 98 |

| 五月-18 | 100 |

| 六月-18 | 103 |

| 七月-18 | 105 |

| 八月-18 | 108 |

| 九月-18 | 106.2857 |

| 十月-18 | 107.1548 |

| 十一月-18 | 108.0238 |

| 十二月-18 | 108.8929 |

| 一月-19 | 109.7619 |

| 二月-19 | 110.631 |

| 三月-19 | 111.5 |

| 四月-19 | 112.369 |

| 五月-19 | 113.2381 |

| 六月-19 | 114.1071 |

| 七月-19 | 114.9762 |

| 八月-19 | 115.8452 |

| 九月-19 | 116.7143 |

| 十月-19 | 117.5833 |

| 十一月-19 | 118.4524 |

| 十二月-19 | 119.3214 |

| 一月-20 | 120.1905 |

| 二月-20 | 121.0595 |

| 三月-20 | 121.9286 |

| 四月-20 | 122.7976 |

| 五月-20 | 123.6667 |

| 六月-20 | 124.5357 |

| 七月-20 | 125.4048 |

| 八月-20 | 126.2738 |

| 九月-20 | 127.1429 |

| 十月-20 | 128.0119 |

| 十一月-20 | 128.881 |

| 十二月-20 | 129.75 |

| 一月-21 | 130.619 |

| 二月-21 | 131.4881 |

| 三月-21 | 132.3571 |

| 四月-21 | 133.2262 |

| 五月-21 | 134.0952 |

| 六月-21 | 134.9643 |

| 七月-21 | 135.8333 |

| 八月-21 | 136.7024 |

| 九月-21 | 137.5714 |

| 十月-21 | 138.4405 |

| 十一月-21 | 139.3095 |

| 十二月-21 | 140.1786 |

| 一月-22 | 141.0476 |

| 二月-22 | 141.9167 |

| 三月-22 | 142.7857 |

| 四月-22 | 143.6548 |

| 五月-22 | 144.5238 |

| 六月-22 | 145.3929 |

| 七月-22 | 146.2619 |

| 八月-22 | 147.131 |

| 九月-22 | 148 |

| 十月-22 | 148.869 |

| 十一月-22 | 149.7381 |

| 十二月-22 | 150.6071 |

| 一月-23 | 151.4762 |

| 二月-23 | 152.3452 |

| 三月-23 | 153.2143 |

| 四月-23 | 154.0833 |

| 五月-23 | 154.9524 |

| 六月-23 | 155.8214 |

| 七月-23 | 156.6905 |

| 八月-23 | 157.5595 |

| 九月-23 | 158.4286 |

| 十月-23 | 159.2976 |

| 十一月-23 | 160.1667 |

| 十二月-23 | 161.0357 |